Graph showing growth

Graph showing growth

Introduction

Including the Total Cost of Ownership (TCO) in your quotes isn’t just good practice, it can be a competitive differentiator. Providing clients with an estimate that goes beyond the upfront purchase price, to include all costs of procuring, deploying, operating, and managing the solution over its lifecycle not only increases transparency, but also sets the stage for a long-term partnership rooted in trust and informed decisions.

However, it's not without its challenges. TCO-heavy quotes can appear costly upfront, potentially scaring off clients. Client forecasts can be unreliable and unrealistic, and miscalculations can dent your credibility. It's crucial to balance accuracy and competitiveness when quoting to secure deals without compromising margins.

This article tackles the nitty-gritty of how to estimate and price recurring services in a way that nails the TCO and maximises value.

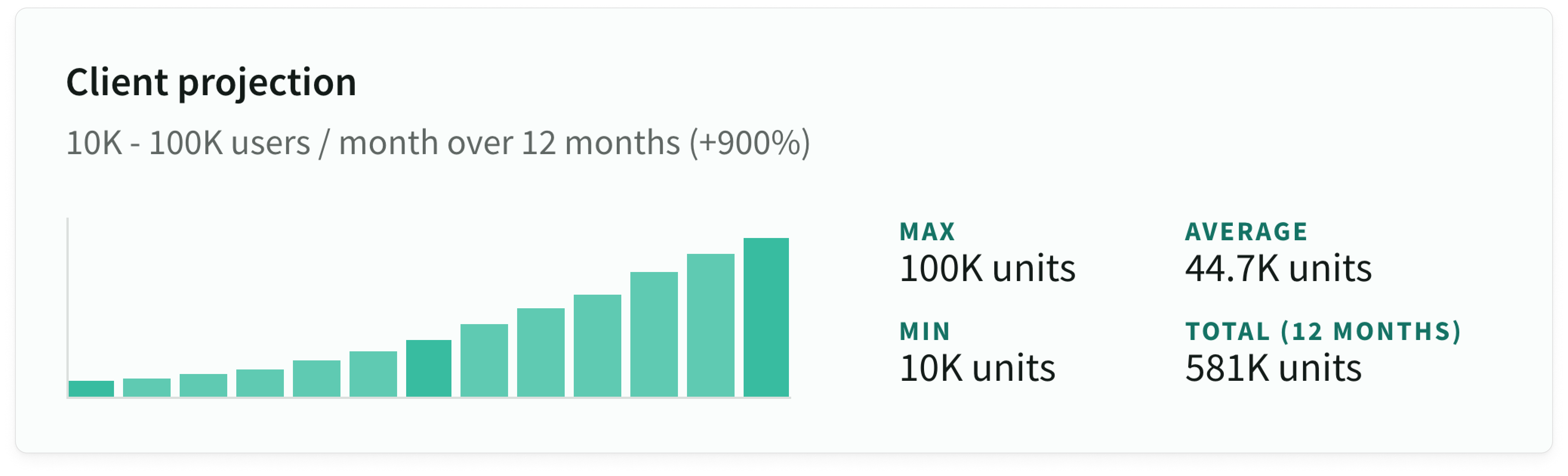

Always qualify your client projections

Have you ever asked a client for their projected volume over the next few years, only to be presented with an exponential hockey stick from zeros to millions overnight?

Clients' growth forecasts can be wild. Base your TCO on their projections, and you risk either sky-high prices or selling yourself short. Using their current user base? That just implies your solution won't add value. Pick a middle-ground growth rate, and it seems arbitrary. It's a tricky balance.

Not only are projections unpredictable, but if you get them wrong you risk undervaluing your solution, and either killing your margins or killing the deal.

Here are 5 must-follow tips for nailing down reliable client projections:

- Cover all your bases: Always ask for pessimistic, realistic, and optimistic projections across several timeframes (year 0, year 1, year 2, etc). It gives you a range to work within.

- Dig for strategy: Ask what the client plans to do to achieve these projections. Are they increasing their marketing budget? Launching into new markets? The 'how' is just as important as the 'how much'.

- Reality check, please: Don't hesitate to challenge figures that seem out of touch. If the client's numbers deviate significantly from historical data, it's time for a conversation.

- Use your judgement: Draw upon your industry experience for a sanity check. While they may aim for the stars with a 50% growth rate, Harvard Business Review suggests a more reasonable 10-25% annual growth for most companies.

- Understand the why: Get to the bottom of the client's underlying business case. Your TCO should map back to these very metrics, be it cost per user, per session, or per service. It's about value, not just numbers.

Client projection

Client projection

Pick the right model to price growth

Estimating TCO against top-level projections or growth rates is a balancing act. The challenge? Picking the right model that suits not just your business objectives, but also aligns perfectly with client needs and operational realities. So, how do you make that crucial choice? Let's dive in.

Here are our 6 tips for selecting your TCO growth model:

- Nail down your primary cost metric: Before you even dive into the numbers, decide what you're measuring. Whether it's active users or data requests, make sure it aligns with both your business objectives and client expectations. If your key metric is 'active users', and you're in the B2B SaaS space, ensure that this is a metric both sales and service delivery teams are familiar with.

- Monthly is your sweet-spot: Aiming for monthly projections isn't just convenient; it's strategic. Monthly figures work well for internal planning, and they're also the standard for most client invoicing. They strike the right balance between granularity and big-picture trends.

- Opt for a growth model that makes sense: Sure, a fixed rate is easy to calculate, but if your business experiences seasonal fluctuations, you're setting yourself up for failure. Select a growth model that reflects your actual business operations. That means if you're an e-commerce solution provider, maybe a seasonal model works best for you. If you're in a steady-growth industry like cloud services, a simple linear or annual compound growth rate might be more suitable.

- Simplify with a calculator: Don't make this harder than it has to be. Create a simple calculator that plugs in your rate and duration to spit out monthly figures. This isn't just a time-saver; it's a sanity-saver for anyone who has to work with these numbers down the line.

- Prepare for all outcomes: Use scenario planning to range from worst-case to best-case scenarios. This doesn't just give you a flexible estimation model but also offers the client strategic insights that underline your foresight and adaptability.

- Automation can be your best friend: Platforms like Estii automate the tedious parts of estimation like calculating recurring units and mapping them to client projections. Use tech to your advantage so you can focus on what actually requires human intelligence — understanding your customer's needs, quickly validating different scenarios and tailoring your solutions accordingly.

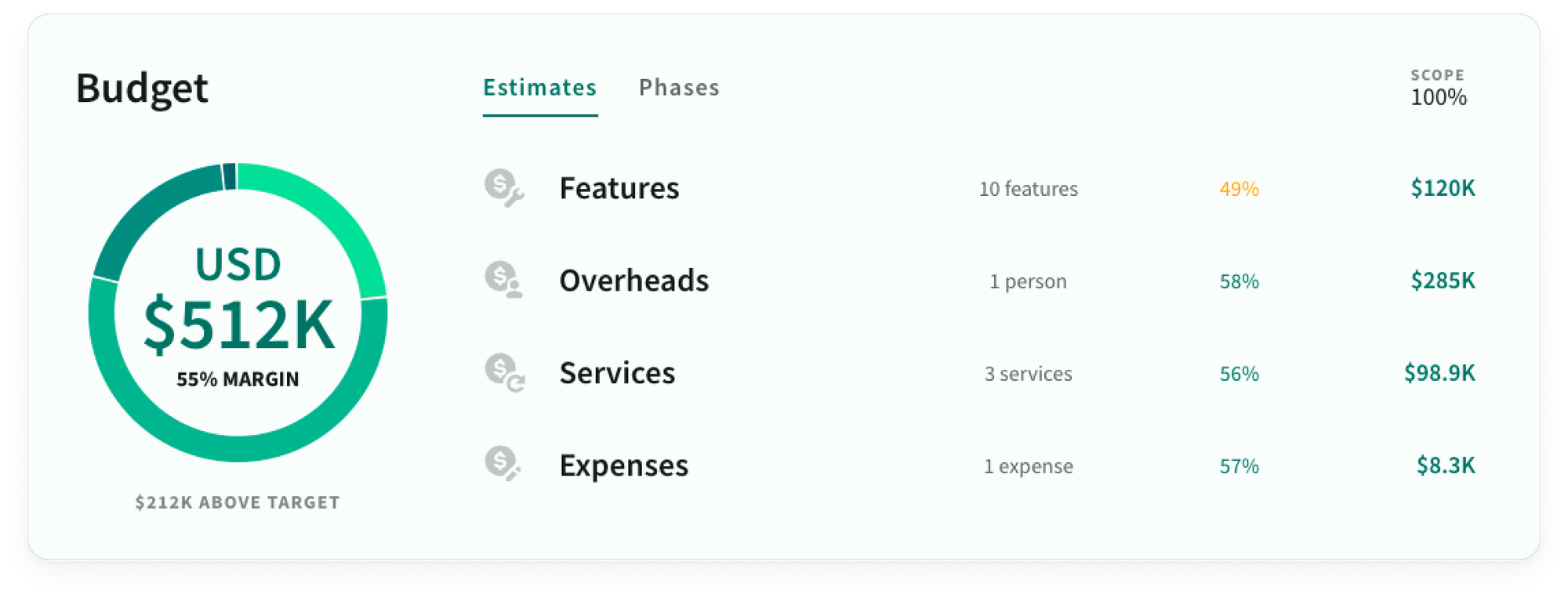

Unpack the “total” cost of ownership

Getting the Total Cost of Ownership (TCO) right isn't just about understanding initial expenditures Many solution providers miss the boat on capturing ongoing costs, whether it's simple line items like software licenses or more nuanced costs such as the effect of inflation over time. Here’s a more detailed rundown to ensure your TCO is, well, truly total.

Your comprehensive TCO checklist:

- Licensing Costs: Consider if your licensing fees are one-time or recurring and how they scale with growth.

- People and Labor Rates: Use blended rates for your teams and don’t forget to factor in yearly salary increments.

- Hosting and Infrastructure Costs: Understand that costs typically go up with increased usage, but unit costs can drop when you scale. Also, consider the cost lifecycle of cutting-edge or legacy services.

- Inflation's Compounding Impact: A small annual increase in baseline costs can quickly escalate, impacting profitability in the long term.

- Storage and Backups: Expect usage and, consequently, costs to increase consistently throughout a project's lifecycle.

- Software and Tool Subscriptions: Account for recurring subscriptions or annual renewals for internal tools and software.

- Hardware Lifecycle: Workstations and servers age, requiring replacements roughly every 3-5 years.

- Support Tiers: Be clear about your support structure, whether it’s 24/7, business hours only, or includes a dedicated account manager.

- Employee Training: Turnover is inevitable; budget for ongoing training for new team members.

- Compliance and Security: Regulatory landscapes change, and maintaining compliance or security standards might necessitate system upgrades.

- Maintaining the Status Quo: Third-party platforms evolve, and either maintaining integrations or supporting legacy dependencies has its own costs.

Having a thorough TCO not only adds credibility to your quotes but also allows your clients to make better-informed comparisons. It can also highlight competitors who have only considered the upfront costs and most evident ongoing expenses, giving you a strategic edge.

Deal budget

Deal budget

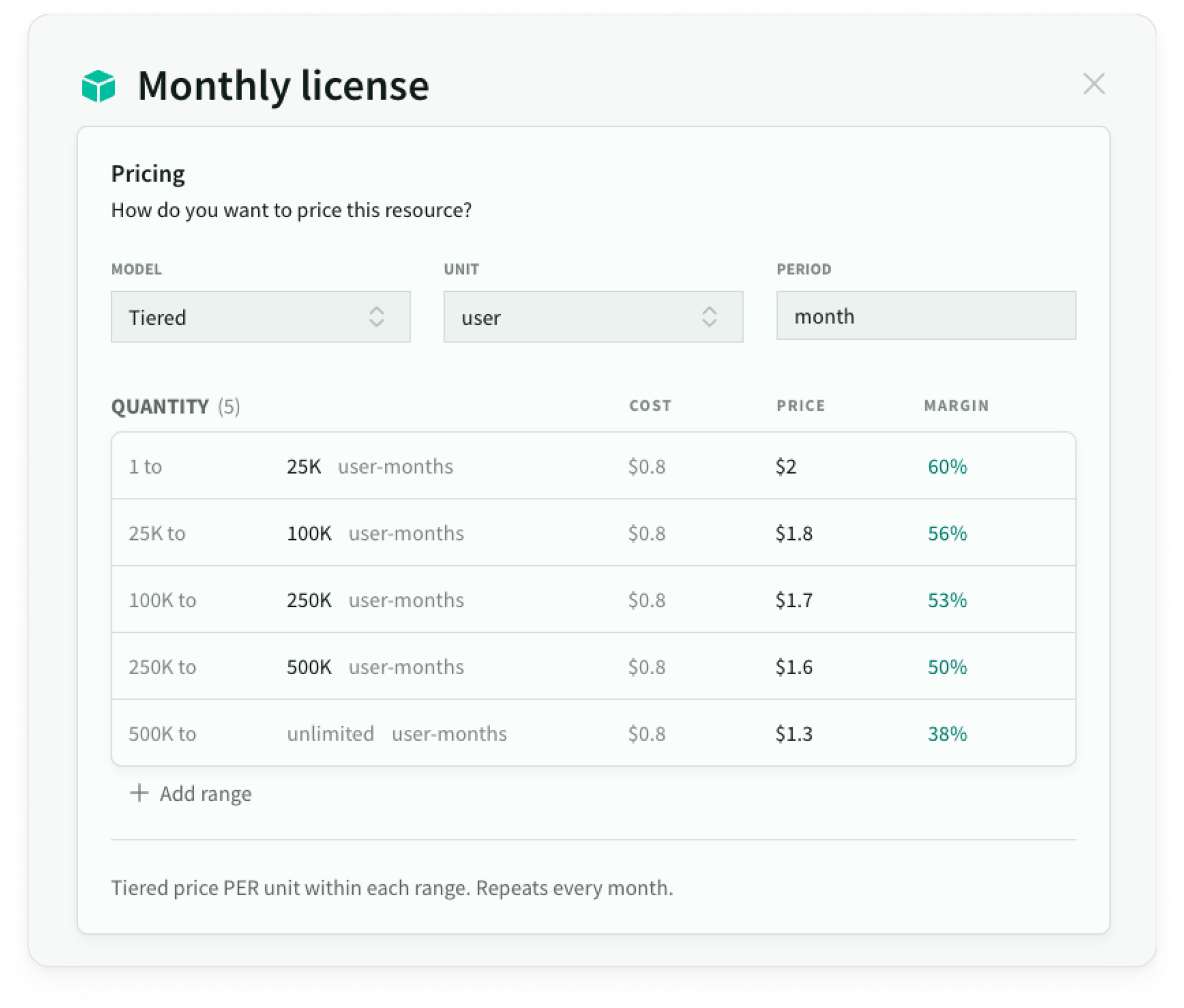

Navigate your recurring costs

Recurring costs can be a maze, especially for those in the solution provider and MSP space. From cloud usage and software licenses to support tiers and ongoing maintenance, the variables are endless. And when each has a different scaling cost based on projections, it gets even more complicated. But this is a challenge you can't afford to fumble; getting it wrong can erode your profitability and sour client relationships.

Here's a road map for mastering the complexities of recurring costs:

- Start with product-specific pricing sheet: Whether it's tied to your monthly projections or a fixed ratio, each product or service needs its own pricing sheet. This sets the foundation for all further calculations, and help standardise approach to internal and 3rd party costs. Where possible, use historical or similar data to inform pricing

- Understand your pricing models: Are your costs fixed per month, per unit, or tiered based on volume? Each model will require a different approach for calculating the final price.

- Itemise and calculate: For each product or service, add a row in your spreadsheet and work out the monthly costs. This granularity will save you headaches down the line.

- Factor in scale benefits and variability: Costs aren't static. They can scale up or down based on volume, and different elements (like licenses, add-ons, infrastructure) may have different scaling factors. Be mindful of these as you go along.

- Embrace automation where possible: Platforms like Estii can significantly ease the burden of estimating these complex costs. Utilise such tools to manage dynamic price lists and implement advanced pricing rules without sweating the manual calculations.

- Model complex scenarios: Whether you're dealing with tiered pricing or cloud infrastructure charged per minute, utilise online pricing calculators to help model your complex cases effectively. For example cloud providers like AWS, Google and Azure all provide advanced cost calculators (links below). This helps in not just estimating but also in demonstrating flexibility and insight to the client.

Monthly license

Monthly license

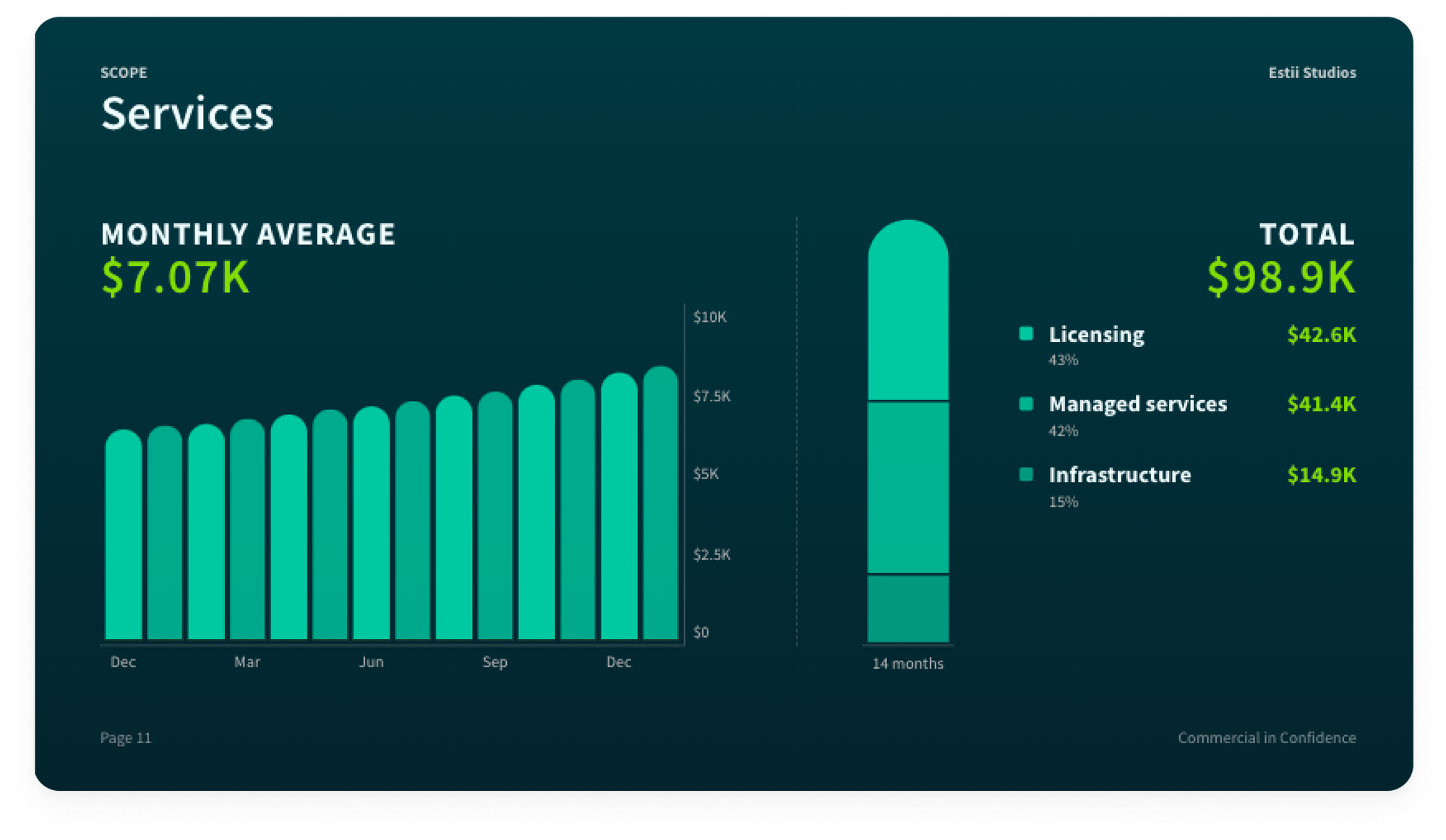

Validate and visualise the estimates to communicate value

Getting estimates right is only half the battle; you also have to communicate their value effectively. In a world where usage and activity costs can vary by the minute, ensuring your estimates stand up to scrutiny is crucial. Moreover, you have to package these estimates in a way that resonates with your client's needs and priorities.

Here are the keys to validating and visualising your estimates like a pro:

- Sanity check your numbers: Before anything else, make sure your numbers add up and make sense. Visual aids can be particularly useful for this. Plotting costs on a monthly or annual timeline can flag any outliers or disproportionate items.

- Leverage your price sheet: If you've set up a pricing sheet per product or service (and you should have, as per our previous advice), use this to quickly tune your estimates. It's more efficient than manual adjustments for each period.

- Consult the experts: Always validate your estimates with Subject Matter Experts (SMEs). They can provide invaluable insights into whether you're inflating or deflating your operational costs.

- Scenario planning is your friend: Build scenarios for low, medium, and high projections. Extend these across different timelines (1, 2, 3 years). This gives you and your client options and sets realistic expectations.

- Pick the right scenarios: Opt for scenarios that best illustrate value to the client. Typically, a low, medium, and high estimate for year 1 and perhaps a medium-range for a 2 or 3-year TCO works well. Remember, clients usually focus on immediate costs and want assurance for the future.

- Tell the TCO Story with ROI: Use your client's ROI metrics to make the cost story compelling. If it's going to cost $X per year, break it down to $Y per user per month after the first year. This makes the investment more relatable and easier to justify.

Validation and visualisation aren't just about getting the math right; they're about building a narrative that convinces the client of the value you're offering. Do this well, and you're not just closing a deal; you're laying the foundation for a long-term, successful partnership.

Service proposal

Service proposal

Conclusion

In a nutshell, getting TCO right is crucial but notoriously tricky.

That's where tools like Estii come in, stripping away the complexity and giving you the agility to adapt quicker. With Estii, you're not just pricing and closing deals—you're building long-term partnerships rooted in trust and transparency. So go ahead, make estimation your strategic advantage. With the right tools and strategies, you'll navigate this high-stakes tightrope like a pro.