If you are a RevOps leader or CFO, you probably recognise this pattern:

You do not have a reliable system of record for delivery economics at the moment that matters most: before you sign the deal.

You only find out the truth later:

- in delivery, when “small” scope changes pile up

- in finance, when margin misses show up after the quarter closes

- in leadership, when forecast confidence is low and everyone blames “bad inputs”

Most teams try to bridge the gap with a patchwork:

- spreadsheet-based quoting and estimation

- a CRM for pipeline and forecasting

- a project tool for delivery

- a finance system for invoicing and reporting

- tribal knowledge to connect the dots

The result is a quiet tax you pay every week:

- margin surprises and “deal regret”

- slower approvals because nobody trusts the numbers

- painful handovers because delivery didn’t help shape the estimate

- endless reconciliation because “the spreadsheet” is not a system of record

- duplicated admin across sales ops, delivery ops, and finance

And as you scale, the tax compounds.

This guide is designed to help you build a compelling business case for investing in an estimation platform, and to do it in a way that stands up in a CFO review: clear outcomes, measurable targets, and a credible change plan.

What an estimation platform actually is (and what it replaces)

An estimation platform is not "another tool." It is the missing commercial layer between CRM and delivery that:

- turns scope assumptions into priced work

- makes margin targets enforceable instead of aspirational

- gives sales, delivery, and finance a shared view of the same deal

- reduces rework by keeping scope, schedule, and price linked as things change

It becomes the place where "what we sold" and "what it will take to deliver" are negotiated together, with an audit trail your teams can trust.

The CFO/RevOps outcomes (in plain language)

1) You get everyone on the same page

Most margin blowouts are not caused by bad intentions. They are caused by misalignment:

- sales sells an outcome

- delivery sees unknowns and constraints

- finance needs predictability and defensible margin

An estimation platform forces the conversation into one shared model: scope, resourcing assumptions, pricing, margin, and payment structure are linked and visible to the people who own the consequences.

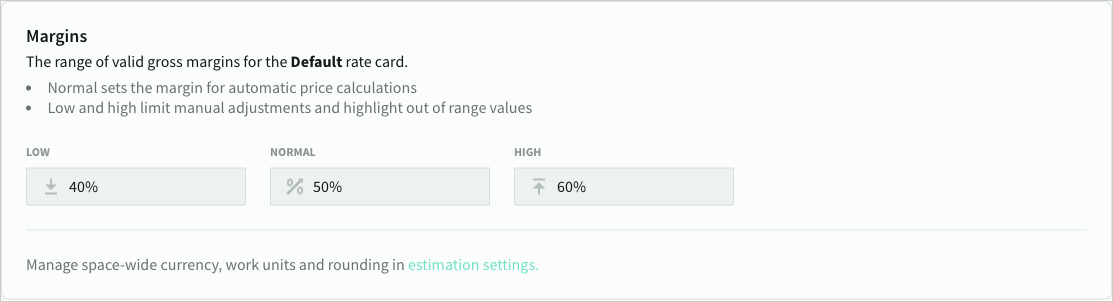

2) You can set margin targets and actually hold them

"Target 50% gross margin" is not a strategy if teams cannot see margin while negotiating, or if margin is calculated differently across spreadsheets.

An estimation platform lets you define:

- standard role rates and margins

- guardrails (min/normal/max)

- rounding rules (so pricing looks deliberate)

Then deals stay inside those rails unless an authorised person explicitly chooses to go outside them (with a reason).

3) You consolidate systems and remove reconciliation work

If you have:

- multiple spreadsheets per deal

- multiple versions emailed around

- multiple sources for "the" scope and timeline

You are paying for it twice:

- directly in RevOps time spent reconciling data

- indirectly in deal delays, delivery friction, and margin leakage

An estimation platform consolidates the estimation model into one place, then exports and integrates outwards to the tools you already use. The point is not to replace your stack. The point is to stop reconciling it manually.

4) You get a single view of truth for sales, delivery, and finance

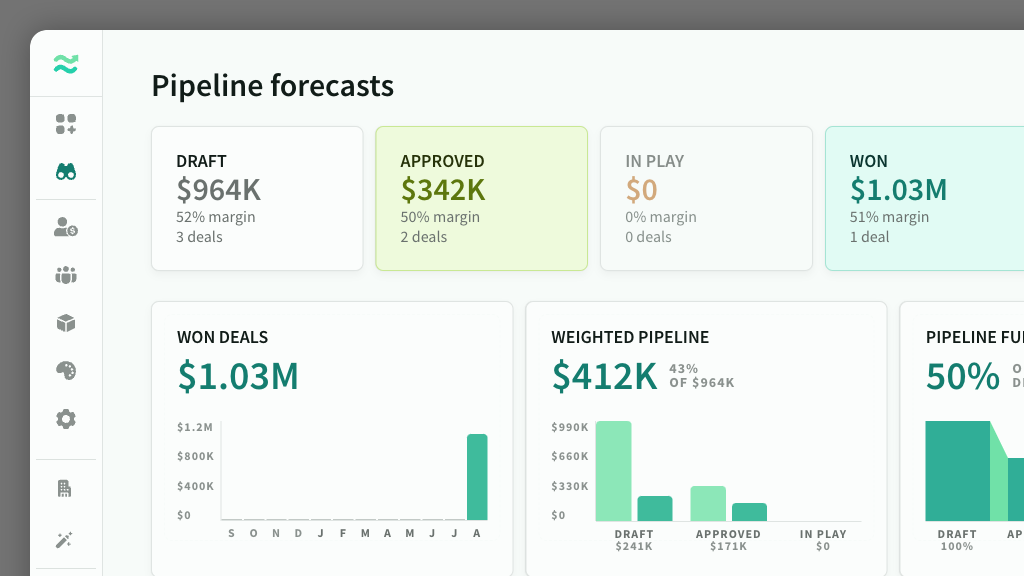

This is the real payoff for RevOps and CFOs:

- pipeline has a commercial model attached

- delivery sees what was sold, with assumptions and structure

- finance sees margin and payment profile before signing, not after the fact

No more arguing about which spreadsheet is "the latest."

The measurable outcomes (what to put on the one-slide ROI summary)

You do not need a perfect ROI model. You need a credible one. Use these measurable outcomes:

- Margin improvement: reduced margin leakage from under-scoping, unpriced change, and rushed timelines

- Cycle time reduction: faster quote iterations, fewer approval loops

- Win rate lift: faster response time + more confident pricing narratives

- Lower cost of sales: fewer hours spent building and re-building estimates

- Cleaner handover: fewer post-sale surprises and rework

- Forecast accuracy: better pipeline quality because deal economics are explicit earlier

Pick 2-3 that matter most in your org. Do not try to sell all of them at once. CFOs fund focus.

A CFO-friendly business case framework (that does not rely on hero assumptions)

Use this structure when building the internal case.

Step 1: baseline the current state

Answer these questions with real examples (not averages):

- How many spreadsheets exist per deal, and who owns them?

- How often do we rework estimates because something changed?

- Where does margin get calculated today, and how consistent is it?

- How often does delivery raise "we didn't price this" after the deal is signed?

- How long does it take to turn a scope change into an updated price and timeline?

Add 2-3 deal stories. CFOs fund outcomes, not opinions.

Step 2: define targets and guardrails

Your targets should be enforceable:

- target gross margin per service line / region

- minimum acceptable margin for exceptions

- standard roles/rates for pricing consistency

- rounding rules for buyer-facing presentation

This turns "pricing discipline" into a system, not a training program.

Step 3: quantify the value using conservative math

Use simple, conservative assumptions:

- If you improve realized margin by 1-2 points on your services revenue, what is the annual impact?

- If you cut quote cycle time by 20%, what does that do to pipeline throughput?

- If you reduce unpriced change by one change request per deal, what is the savings?

You can then compare that to:

- platform cost

- implementation time

- internal change cost

If the case only works with aggressive assumptions, it is not a good case.

Step 4: prove it with a pilot plan

The easiest way to get this funded is to propose a tight pilot:

- pick one service line, region, or sales pod

- run 10-20 deals through the platform

- measure: quote cycle time, margin variance, and handover issues

- decide scale-up based on evidence

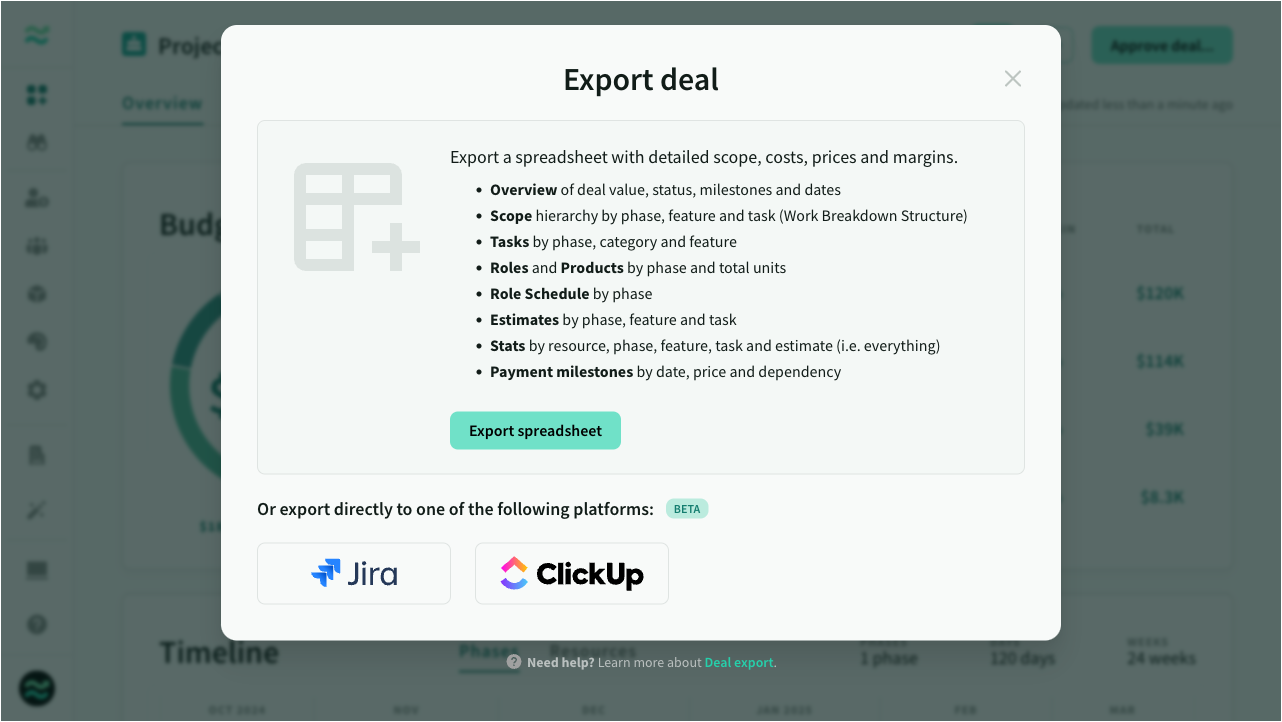

Integration and system consolidation (without ripping out your stack)

RevOps will (rightly) worry about tool sprawl. The pitch is not to replace the CRM.

The pitch is:

- keep CRM as the source of truth for accounts, opportunities, and stage forecasting

- use the estimation platform as the source of truth for scope, pricing logic, and delivery economics

- push structured outputs back into the systems that need them (CRM, project tools, exports)

That means you can integrate back into your current CRM (e.g. Salesforce) without duplicating ownership of core records.

In Estii, exports and integrations are designed to support that operating model.

Related docs:

Change management: the hard part (and how to make it work)

The biggest risk in changing estimation is not technology. It is your embedded process.

If you are coming from a fractured, embedded spreadsheet process, expect resistance. Not because people love spreadsheets, but because spreadsheets are where the organisation negotiated reality for years.

Common failure modes:

- "We will keep the spreadsheet and just copy results into the tool"

- "Only sales uses it" (delivery never trusts it)

- "Only delivery uses it" (sales never adopts it)

- "We will standardize later" (later never happens)

A change plan that actually works

- Start with shared incentives

- sales cares about speed and confidence

- delivery cares about feasibility and clarity

- finance cares about margin and predictability

Your platform adoption needs to serve all three, not just one.

- Standardize the minimum viable model

Do not boil the ocean. Start with:

- a short list of roles and baseline rates

- a margin target range

- a standard structure for scope and assumptions

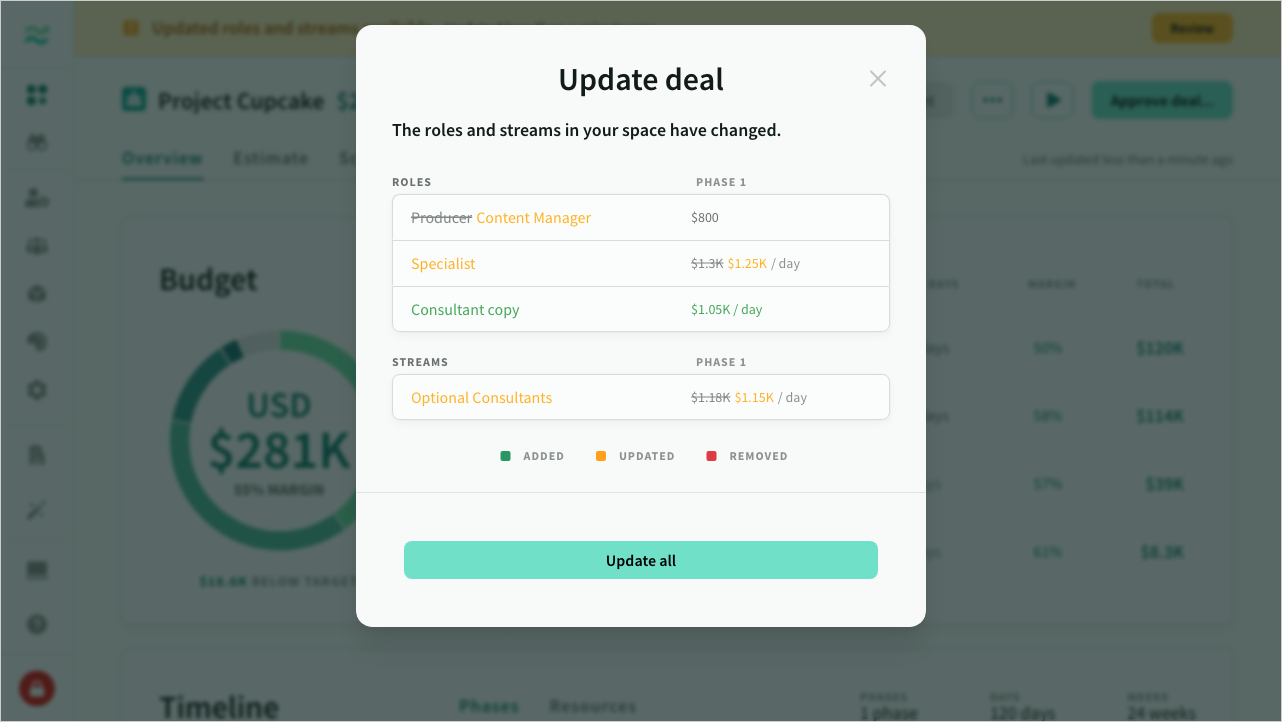

- Make updates explicit, not silent

One of the reasons spreadsheets cause mistrust is silent drift: rates change, assumptions change, and no one can tell what moved.

Modern estimation platforms treat upstream changes as reviewable updates, so you can keep deals consistent without surprising teams.

Related docs:

What to look for in an estimation platform (CFO checklist)

If you are evaluating platforms, the shortlist should answer:

- Can we set margin targets and guardrails centrally?

- Can we model roles, rates, and pricing rules in a reusable way?

- Can we keep scope, schedule, and price linked when a deal changes?

- Can we export structured scope to delivery tools?

- Can we integrate into our CRM (e.g. Salesforce) without duplicating data ownership?

- Can we support controlled change in a business with entrenched spreadsheets?

If a platform cannot answer those questions, it will become "another spreadsheet."

Where Estii fits (and how it supports the operating model)

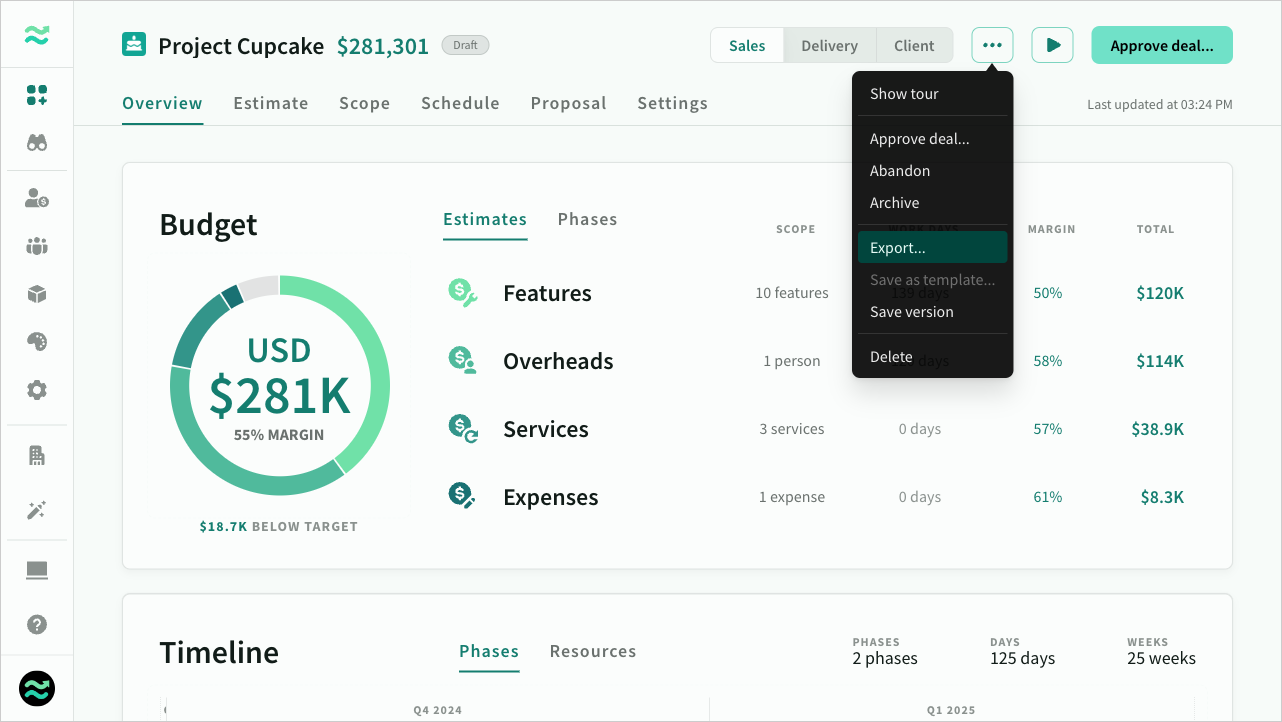

Estii is designed around the idea that scope, schedule, and pricing must stay linked while humans negotiate the tradeoffs.

Key building blocks:

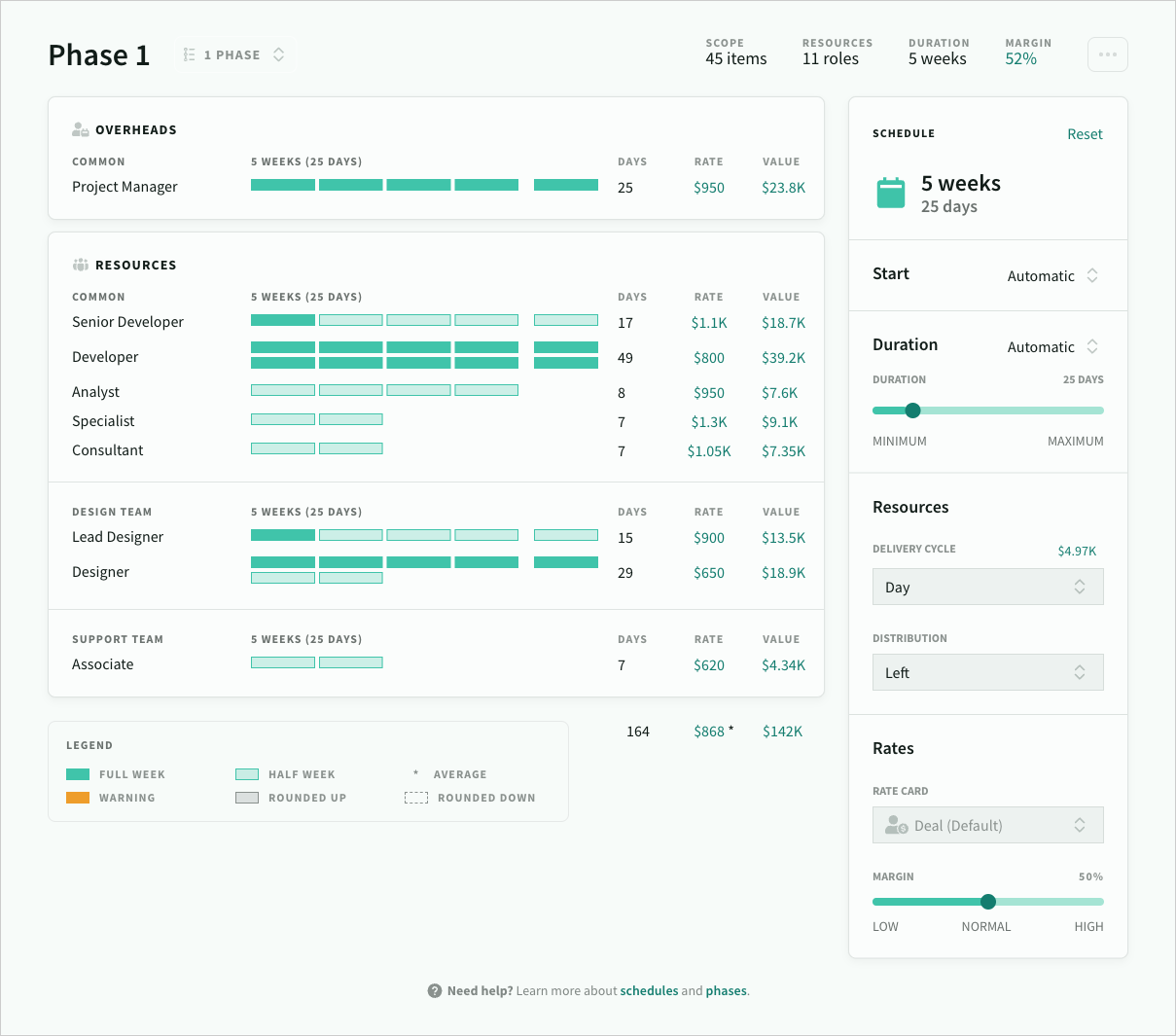

- Roles and rate cards for standardized pricing and margin guardrails

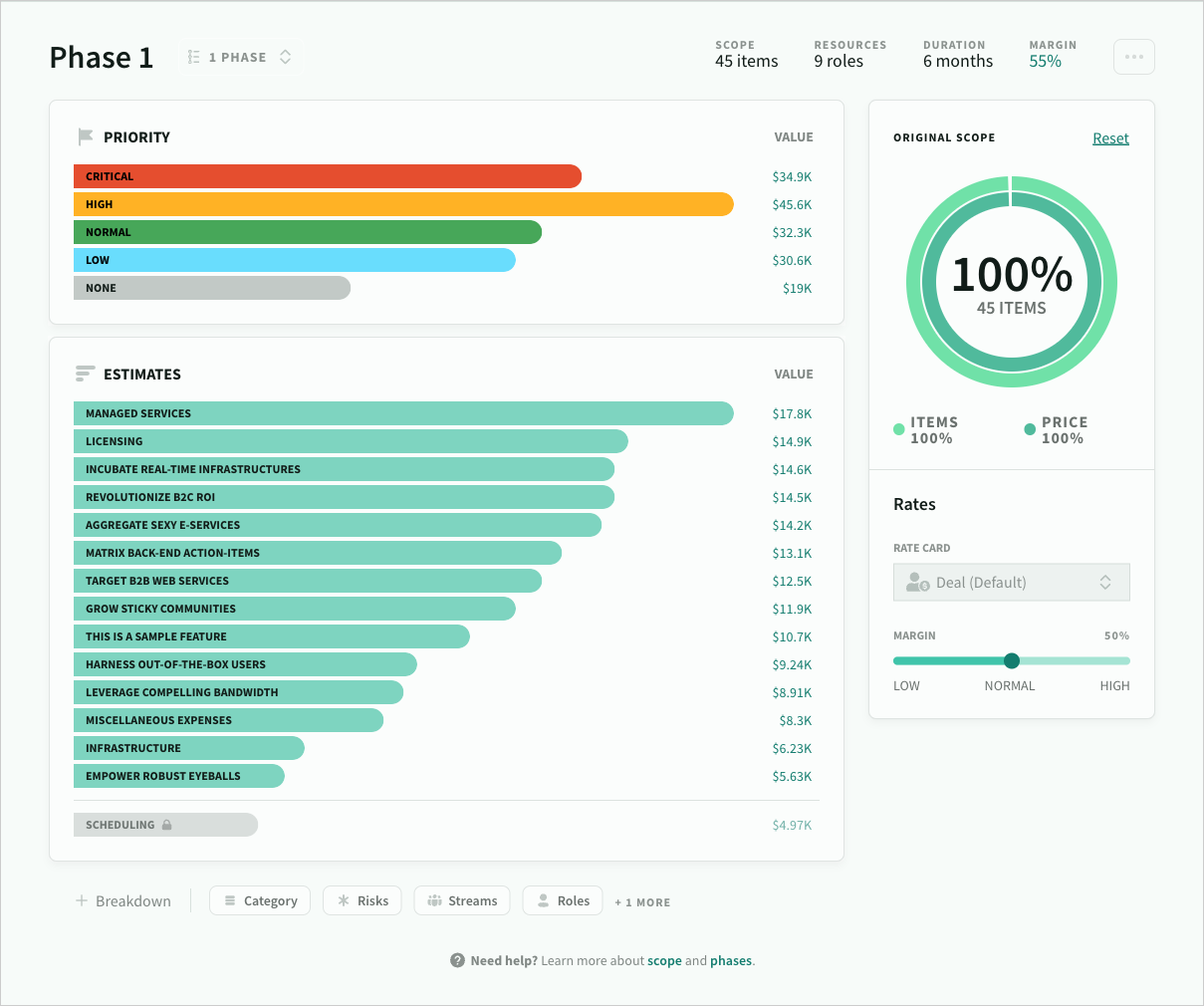

- Scope breakdowns to trade scope against price deliberately

- Schedule to make resourcing and timeline assumptions explicit

- Exports and integrations to push structured outputs into delivery tools

- Updates and versions to manage change without losing trust

Related docs:

Closing thought

If you are trying to run a services business with predictable margin, spreadsheet-based estimation is not a harmless habit. It is a structural risk.

The business case for an estimation platform is simple:

make deal economics explicit early, align teams around one model, and protect margin through guardrails instead of hope.