Most pricing mistakes aren't about math. They're about choosing a contract model that doesn't match uncertainty.

You can have the best team in the world, and still lose money (or lose trust) if you:

- pick fixed price when scope is still fluid,

- pick time & materials (T&M) when the buyer needs cost certainty,

- sell a retainer when you don't have a stable, repeatable delivery motion.

This guide gives you a practical decision framework, plus concrete guardrails you can use to keep scope, schedule and commercials aligned as the deal changes.

The quick decision matrix

Use this as a starting point. Most deals land in a hybrid, but the dominant pattern matters.

Fixed price is strongest when…

- scope is stable enough to define acceptance criteria

- dependencies are known and controllable (or explicitly excluded)

- you can reuse delivery patterns (repeatable work)

- the buyer expects a clear “deliverable list” and isn't buying “capacity”

The risk: you under-spec the work, then bleed margin in delivery.

T&M is strongest when…

- scope will change (product discovery, integrations, legacy, unknowns)

- the buyer is comfortable with a governance model (weekly steering, burn reporting)

- outcomes are clear, but the route to get there isn't

The risk: buyers feel exposed (“blank cheque”) unless you package it with controls.

Retainers are strongest when…

- you have a recurring service motion (ongoing ops, support, content, optimisation)

- you can define the service boundary clearly (what's included, what's not)

- the buyer needs predictable spend (and you need predictable utilisation)

The risk: you sell “on-call delivery” without limits and become the buyer's overflow team.

A simple way to classify uncertainty

Before choosing a model, classify the uncertainty you're actually dealing with:

- Product uncertainty: the buyer is still deciding what they want

- Technical uncertainty: unknown integrations, performance, legacy complexity

- Delivery uncertainty: resourcing constraints, availability, onboarding overhead

- Commercial uncertainty: procurement, payment terms, timeline urgency

If uncertainty is high, fixed price isn't “wrong” — it just needs tighter guardrails and a structure that allows change.

How each model fails (and the early warning signs)

Fixed price failure mode: silent scope creep

Early signs:

- “It's a small change” appears weekly

- acceptance criteria are vague (“make it work like X”)

- estimates are written at feature level but delivery needs task-level detail

Guardrails:

- explicit assumptions, exclusions, and dependencies

- a change request mechanism (even if lightweight)

- a scope hierarchy that can be descoped by priority without breaking coherence

T&M failure mode: buyer distrust

Early signs:

- buyer asks for hard guarantees on total cost, while also changing scope

- weekly check-ins become debates about hours rather than outcomes

- the team starts “padding” because they feel commercially unsafe

Guardrails:

- a clear cadence (weekly plan, demo, burn, decisions)

- a cap or “not-to-exceed” envelope for each phase

- an agreed scope baseline to measure change against

Retainer failure mode: infinite backlog

Early signs:

- buyer expects “everything” under the retainer

- priorities swing with internal politics

- you can't forecast utilisation because requests are unbounded

Guardrails:

- explicit service boundary (support tier, response times, channels)

- a queue with prioritisation rules

- a separate track for “projects” vs “service”

Hybrids that work well (and why)

Most healthy service businesses use hybrids because uncertainty changes over time.

Discovery fixed, delivery T&M (or fixed)

Use a fixed-price discovery phase to remove the biggest unknowns:

- requirements and acceptance criteria

- integration map and dependencies

- delivery plan and schedule options

- commercial options (fixed vs capped T&M)

Then choose the delivery model with better information.

Fixed scope, variable usage (TCO-style)

When the build is stable but usage changes costs, separate the commercials:

- build: fixed or capped T&M

- run (recurring): unit-based pricing tied to usage projections (user-months, GB-months, instance-hours)

This is where recurring, unit-based pricing wins: it stays fair as usage changes.

Retainer for run, change requests for build

If you sell managed services, keep the boundary clean:

- retainer covers support/ops within limits

- project work is estimated and approved separately

Packaging cost certainty without lying

Buyers often ask for certainty. The most dangerous response is pretending certainty exists.

Instead, offer structured options:

- Option A (fast + flexible): T&M with weekly governance and a cap per phase

- Option B (balanced): fixed price with explicit assumptions + change requests

- Option C (predictable): retainer for run + fixed discovery + delivery cap

The buyer isn't choosing “pricing.” They're choosing a risk-sharing arrangement.

How to operationalise this in Estii

The goal is to keep scope, schedule, and price linked so you can iterate without creating a spreadsheet mess.

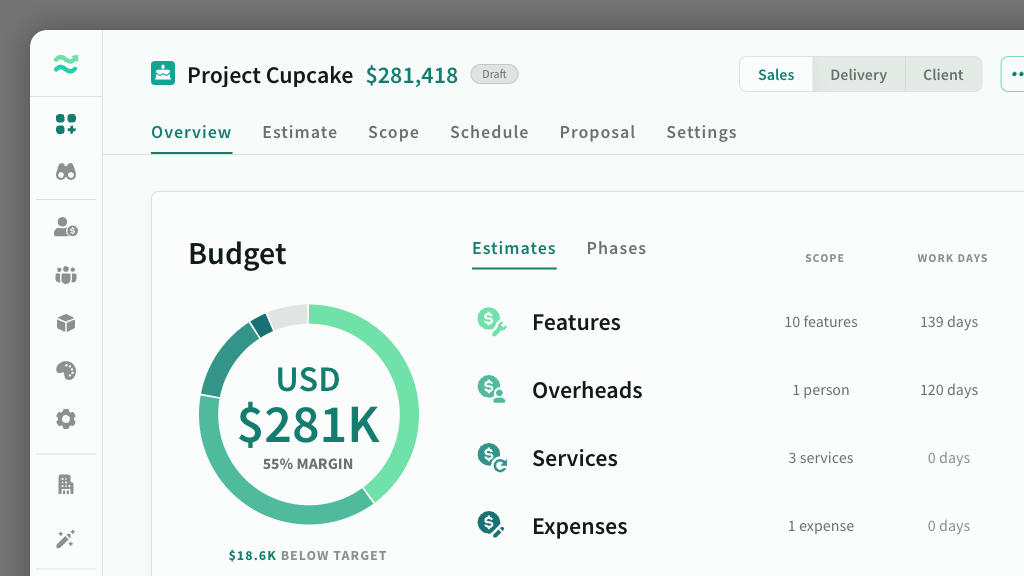

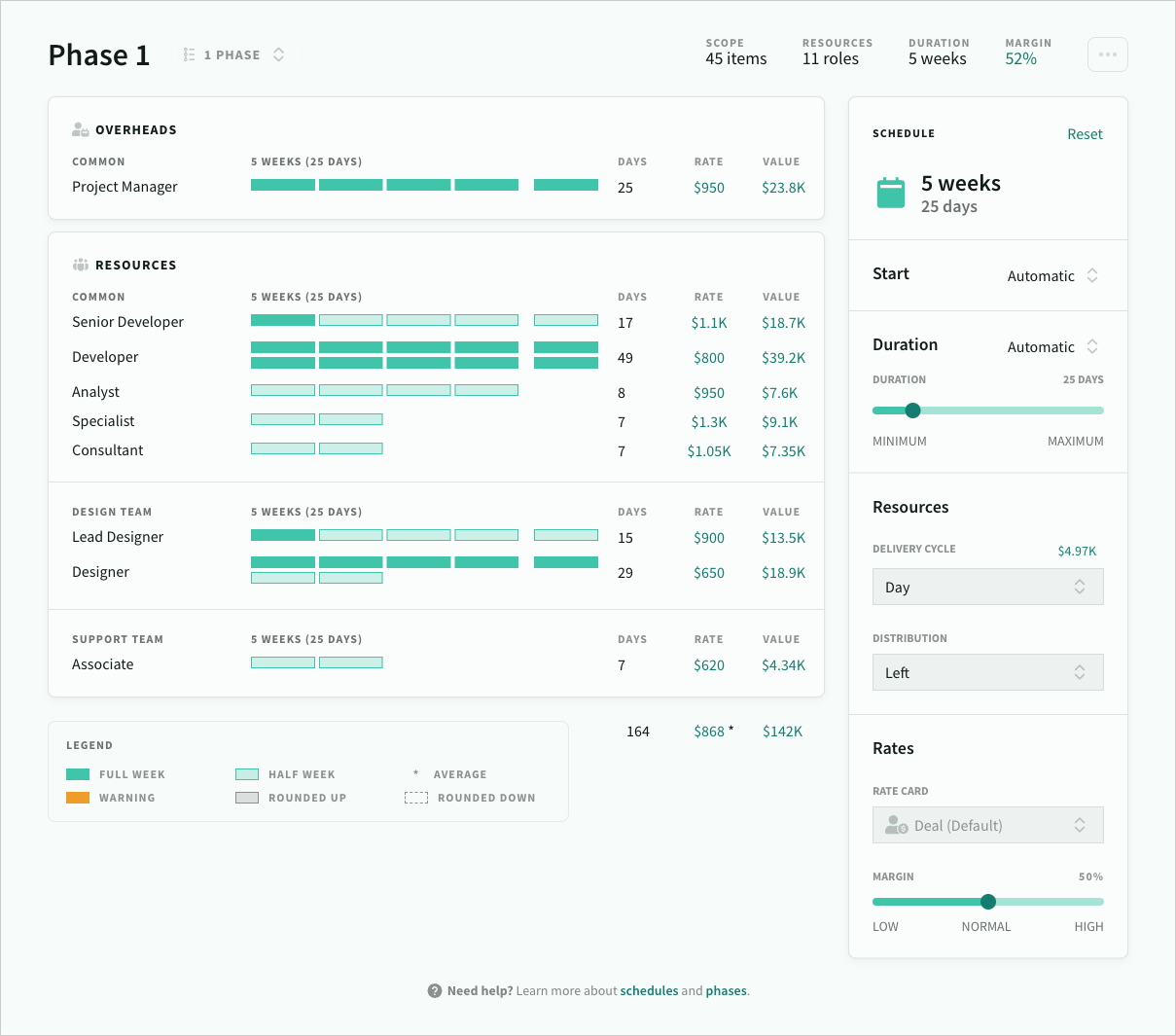

Model roles and margin guardrails

- Set up roles with clear cost and price, and a margin range so you can see when concessions are breaking the model.

- Use multiple rate cards if you need different commercial strategies (regions, rush rates, cost centres).

Related docs:

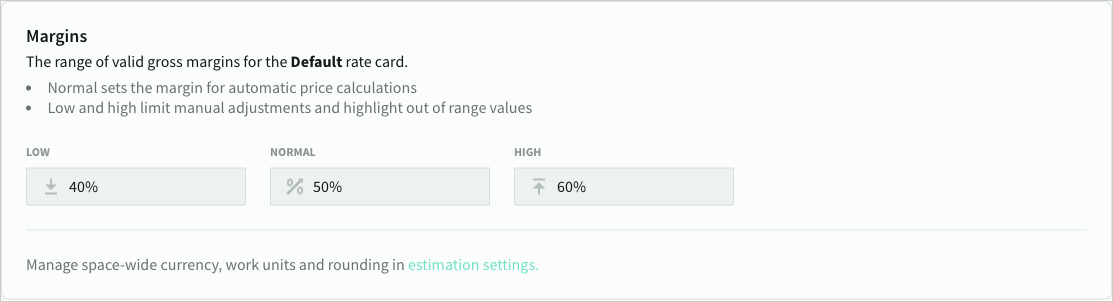

Use scope as the commercial lever

Scope isn't just a list — it's your negotiation surface:

- tag work by priority, risk, stream, product, etc

- descope low-value items quickly while preserving the structure of the work

Related docs:

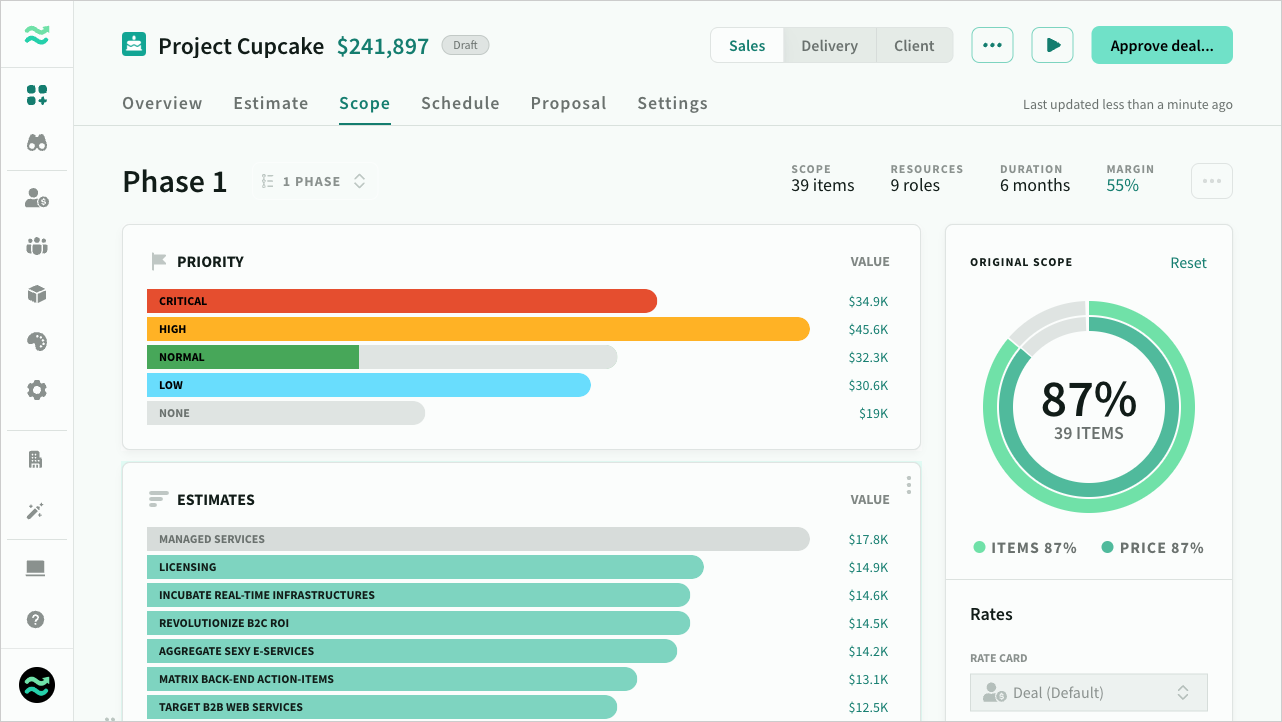

Keep schedule realistic (and explainable)

Scope and schedule drift together. If you compress the timeline, resourcing (and cost) changes.

Related docs:

Define payment structure that matches delivery risk

Milestones help in all three models:

- fixed price: align payments with deliverables/acceptance

- T&M: align payments with cadence and governance

- retainer: define periodic payments and terms clearly

Related docs:

Model recurring/usage pricing for retainers and run costs

When pricing depends on usage, represent it explicitly with unit-based products and pricing periods.

Related docs:

Use versions to manage negotiation changes

Create a snapshot before big commercial moves (discounts, scope cuts, timeline changes), so you can compare “before/after” and avoid confusion.

Related docs:

Package it cleanly for the buyer

The proposal should communicate:

- what's in scope (and what's explicitly out)

- the timeline and resourcing narrative

- the commercials (milestones, terms, appendices)

Related docs:

Closing thought

The best model is the one where your buyer understands what they're buying, your team can deliver without heroics, and your commercials still make sense when reality changes.